To cut costs amid subscription overload in 2025, regularly review your services and cancel those you no longer use or need, focusing on value. Bundle services where possible to save money and simplify bills. Use subscription management tools for tracking and optimizing your plans, and opt for lower-tier or free options when available. Choose brands with transparent policies to avoid hidden fees. Keep control by staying organized—continue exploring tips to make smart choices and maximize savings.

Key Takeaways

- Regularly review and cancel unused or unnecessary subscriptions to reduce costs.

- Bundle multiple services to access discounts and simplify billing management.

- Utilize loyalty programs to maximize benefits from long-term subscriptions.

- Use AI-powered management tools to track subscriptions and avoid hidden fees.

- Opt for lower-tier plans or free alternatives to minimize expenses without sacrificing value.

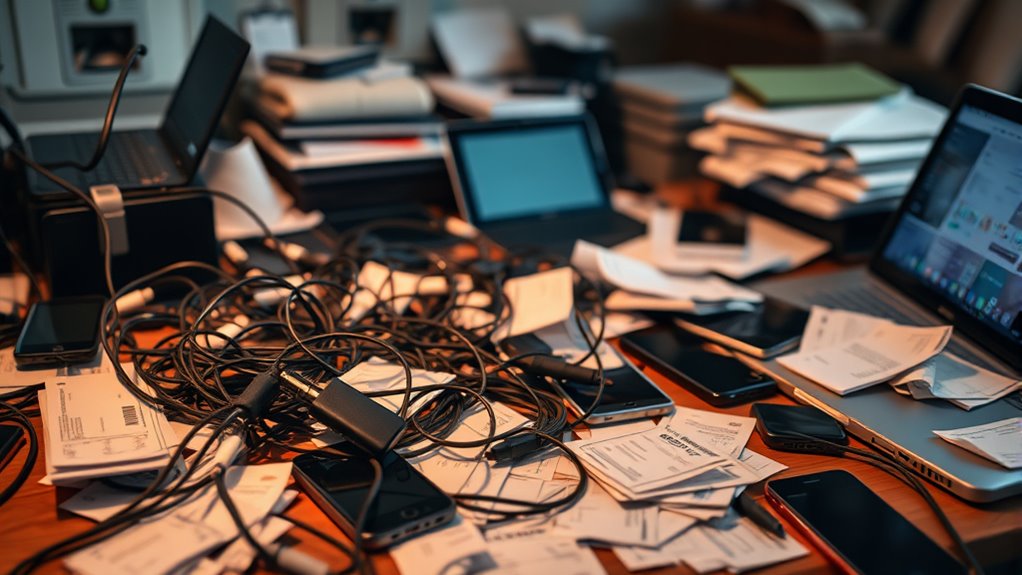

Are you feeling overwhelmed by the explosion of subscription services available today? You’re not alone. The global subscription economy is projected to hit $1.2 trillion by 2030, nearly doubling the $722.5 billion market in 2025. Despite this rapid growth, many consumers are experiencing subscription fatigue, feeling buried under a mountain of recurring payments. This fatigue often leads to cancellations, silent churn, and a sense that you’re paying for unused services. With 42% of consumers feeling overwhelmed and 47% believing they’re wasting money on unused subscriptions, it’s clear that managing your subscriptions is more important than ever.

Subscription fatigue is common as the market doubles, leading to cancellations and wasted money—stay vigilant to manage your subscriptions wisely.

One effective way to cut costs and streamline your subscriptions is through subscription bundling. Many providers now offer bundles that combine multiple services at a discounted rate, giving you more value for less. For example, a streaming service might include music, video, and gaming in one package, reducing the need to subscribe separately to each. Bundling not only saves money but also simplifies your bills and reduces the hassle of managing individual accounts. Additionally, loyalty programs can play a crucial role. Many companies reward long-term subscribers with exclusive discounts, early access, or added perks, encouraging you to stick with a service longer and get more value out of your investment. These programs foster loyalty, making it easier to prioritize essential subscriptions and cancel the ones that no longer serve your needs.

But even with bundling and loyalty rewards, it’s essential to regularly review and assess your subscriptions. Consumer behavior shows that around 30% of people cancel their subscriptions within the first year, often due to rising costs or content overload. To avoid falling into this trap, set a routine to review your subscriptions every few months. Cancel the services you rarely use or don’t find valuable anymore. Remember, consumers tend to prioritize essential and cost-effective services, so focus on the ones that truly enhance your life. Transparency is key—look for brands that offer straightforward cancellation processes and clear billing. Complex procedures or hidden fees only fuel subscription fatigue and erode trust. Subscription management platforms are increasingly integrating AI-powered tools that help consumers track and optimize their subscriptions effortlessly, leading to better control and fewer surprises. Incorporating cost-effective options can help you identify affordable alternatives, such as switching to lower-tier plans or exploring free services, further reducing unnecessary expenses.

In a landscape where subscription revenue continues to grow despite economic uncertainties, the key to managing overload is balancing cost, value, and convenience. By leveraging subscription bundling, taking advantage of loyalty programs, and regularly reviewing your services, you can reduce unnecessary expenses and regain control of your finances. Staying vigilant about your subscriptions helps you avoid wasted money and guarantees that each service you keep genuinely adds value to your everyday life.

Frequently Asked Questions

How Do I Identify Unnecessary Subscriptions Effectively?

To identify unnecessary subscriptions, you should conduct regular subscription audits and expense tracking. Review your bank and credit card statements monthly to spot recurring charges and unknown services. Use subscription management apps to organize and monitor your payments, making it easier to see which subscriptions are rarely used or unnecessary. Comparing usage versus costs helps you decide which subscriptions to cancel, saving you money and reducing digital clutter.

What Tools Can Help Manage Multiple Subscriptions?

Imagine you’re the captain of a ship steering a sea of subscriptions. Tools like Zuora, Chargebee, and Zoho act as your compass and crew, helping you steer through the chaos. They enable subscription bundling and auto renewal management, so you can consolidate services and prevent unwanted renewals. These platforms offer real-time insights, making it easier to keep your fleet organized, trim costs, and stay on course toward smoother sailing.

How Can I Negotiate Better Subscription Rates?

To negotiate better subscription rates, start by researching market prices and vendor discounts. Use subscription bundling to your advantage, asking for package deals that combine services at a lower cost. Don’t hesitate to request promotional discounts, especially if you’re committing long-term or increasing your usage. Be assertive but collaborative, clearly stating your needs and alternatives. This approach increases your leverage and helps secure more favorable terms.

Are There Legal Considerations When Canceling Subscriptions?

When canceling subscriptions, you should be aware of legal considerations like contract termination rights and privacy concerns. Companies must make cancellation easy and transparent, providing clear disclosures about renewal terms and price changes. If they obstruct or delay your cancellation, they risk legal penalties. Always review the cancellation process, guarantee your personal data remains protected, and understand your rights to avoid issues related to deceptive practices or unauthorized charges.

How Do Subscription Fees Impact My Overall Financial Health?

Don’t let subscription fees drain your wallet; they can sneak up on you and cause subscription fatigue. When you lose track of spending, it hurts your financial health and limits your ability to save. To stay in the black, review your subscriptions regularly, cancel unused ones, and seek cost savings. Being proactive helps you avoid surprises, keep control of your money, and maintain overall financial stability.

Conclusion

With over 80% of people subscribing to at least one service, it’s clear subscription overload is real. To cut costs, review your subscriptions regularly and cancel those you no longer use. Prioritize what truly adds value to your life, and consider sharing accounts to save more. Taking control now can save you hundreds annually and prevent financial stress down the line. Don’t let subscriptions drain your wallet—be proactive and keep your budget in check.